canadian tax strategies for high income earners

Canadian tax law allows for several ways to reduce your taxes owed if you know the current. 3 Monitor the cost base of your household.

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

Tax Planning for High Income Canadians.

. A number two deduction relates to interest payments made on investment loans and management costs incurred on investment projects. Tax-sheltered accounts are extremely useful because they help you delay reduce or even avoid paying taxes all together. A donor-advised fund DAF is an investment account created to support charitable organizations.

TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. Spousal Registered Retirement Savings Plan Spousal RRSP Flow-Through Shares. In 2021 the employee pre-tax contribution limit for 401 k and 403 b plans is 19500.

Look Into The Canada Workers Benefit CWB Formerly known as the Working Income Tax Benefit WITB the Canada Workers Benefit CWB is a refundable tax credit for Canadians with a low income. For high income earners Please contact us for more information about the topics discussed in this article. Additionally tax-deferred accounts benefit by compounding returns faster by sheltering income from current taxation.

Interest payments on the earnings are tax-free. The earnings of the tax-exempt bond are typically excluded from income taxes including state income taxes and local income tax rates. This has to generally be done within annual gift exclusions or loans.

Change the Character of Your Income One way to reduce your tax burden is to change the character of your income. Income-splitting and prescribed rate loans While this strategy is particularly effective for wealthier Canadians within the highest tax bracket there are benefits for the average Canadian too. Canadian Tax Loopholes.

If you are 50 or older you are eligible to contribute another 6500 as a catch-up contribution. With a DAF you can make a. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

50 Best Ways to Reduce Taxes for High Income Earners. Each plan defers or mitigates tax obligations in different ways. Canadian Tax Tricks There are numerous tax avoidance strategies which take advantage of rules offer generous tax breaks and are not frowned upon or illegal.

If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. Tax Saving Strategies For High Income Earners Canada. They borrow cash in exchange for fixed payments.

For the nations highest-income earners those making more than 220000 annually the amount going to the tax man is. The math is simple. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts.

However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. If youre a high-income Canadian there are tax minimization strategies that will help you reduce your tax burden. Individuals making between 3000 to 24112 and families with incomes below 36482 are eligible for the tax credit.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. If one spouse is in a higher tax bracket than another they may want to shift some of that taxable income to another family member including children. Convert your SIMPLE SEP or traditional IRA to a Roth IRA.

Tax Saving Strategies for High-Income Earners. If properly structured family trusts or partnerships can help you move your investment earnings to family members with lower marginal tax rates. Take advantage of vehicles for future tax-free income.

The government is not against helping tax payers minimize their tax bills legally. Qualified Charitable Distributions QCD 4. Lets start with an overview of tax rules for.

Contributions to an RRSP lower your taxable income. The more money you make the more taxes you pay. A great example of a safe tax-avoidance strategy is the RRSP Registered Retirement Savings Plans.

How to Reduce Taxable Income. Scottish taxpayers will continue to be subject to income tax at 5 different rates ranging from 19 Starter Rate to 46 Top Rate for any income in excess of. Bonds mature with an initial return for the buyer.

This is done through shady accounting practices or stashing money in offshore accounts in tax-havens like the Caribbean. At higher income ranges their Canada Child Benefit has a claw back of 80 of. Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner.

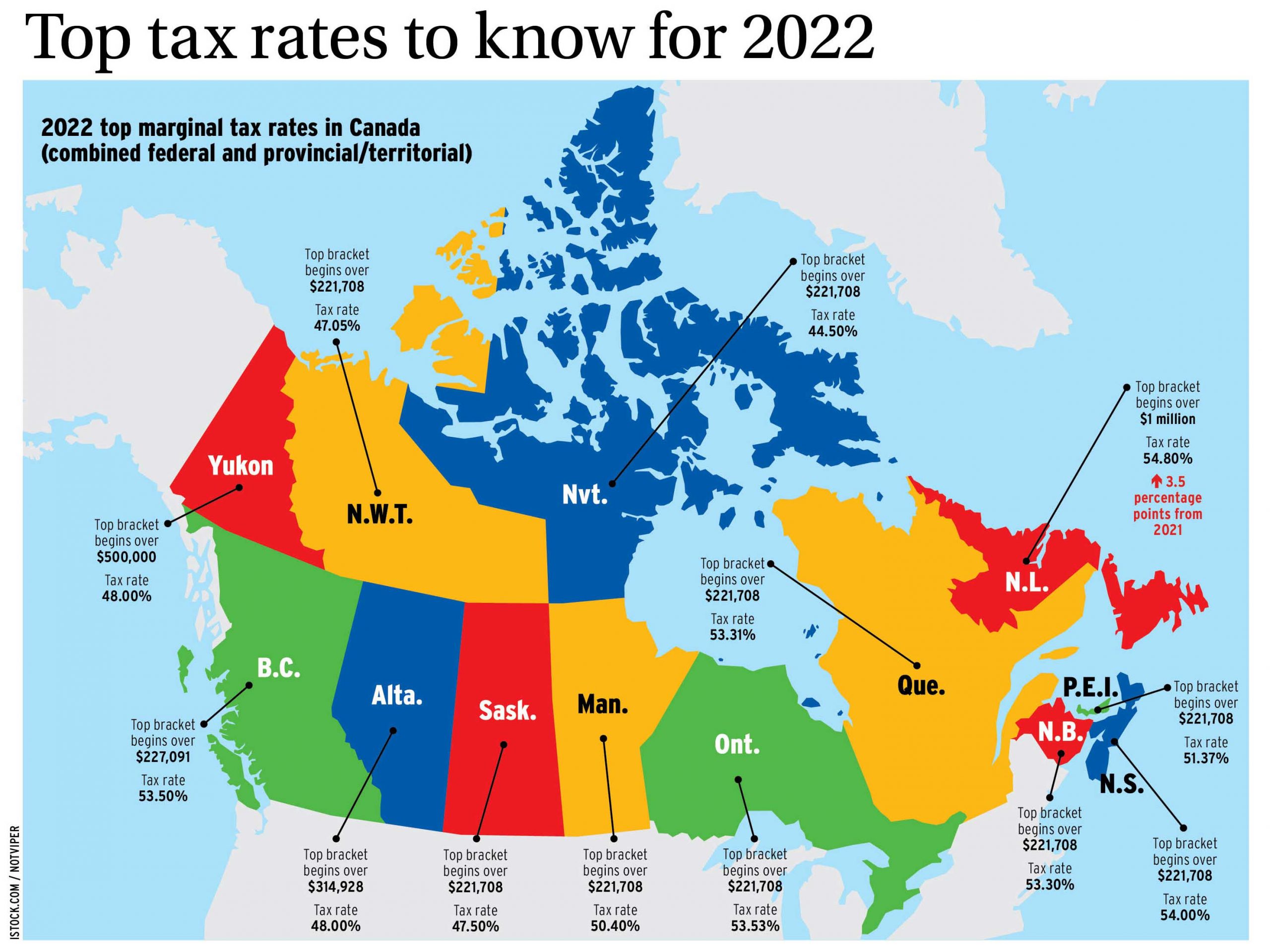

Tax credit 1 for Canadian dividends. While income splitting between family members may no longer be viable the new rules do not prevent higher income spouses from. When personal income exceeds 200000 in Canada the earner has to pay taxes at a rate of 50 or higher depending on the province of residence.

Using these accounts in the right. Every Canadian has access to a few different tax-sheltered accounts to help them legally minimize their taxes. Registered Retirement Savings Plans RRSPs Registered Education Savings Plans RESPs and Tax-free Savings Accounts TFSAs.

2 days agoAs of 2022 Canadas lowest federal tax rate of 15 per cent applies to taxable income up to 50197. 2 From a tax perspective youre better off using cash or savings for these discretionary purchases and then borrowing to invest. High-income earners should consider investing in municipal bonds.

If youre wondering why you should do so here are some of the ways it can help you to lower your tax bill. The interest on anything else you assume to debt to buy is not. Tax minimization strategies for.

6 Tax Strategies for High Net Worth Individuals. Tax minimization strategies for individuals Income splitting with family members Family income splitting is a fundamental tax planning strategy but many Canadians are not taking advantage of simple income.

Taxes 2022 Important Changes To Know For This Year S Tax Season

Advice On Tax Saving Strategies As A Canadian With Over 1m Invested Via My Corporation R Fatfire

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

:max_bytes(150000):strip_icc()/GettyImages-469191068-ac2deb35657a41e58de5bd3a2ff27c62.jpg)

Top 6 Strategies To Protect Your Income From Taxes

Everyday Tax Strategies For Canadians Td Wealth

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

Tax Planning Strategies For High Income Canadians

10 Tax Planning Strategies For High Income Earners Gamburgcpa

Effective Tax Strategies Help You Minimize The Amount Of Tax You Need To Pay Shajani Llp Chartered Professional Accountants Advisors

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

Top Tax Rates To Know For 2022 Investment Executive

Personal Income Tax Brackets Ontario 2021 Md Tax

Personal Income Tax Brackets Ontario 2020 Md Tax

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Advanced Tax Strategies For High Net Worth Individuals Moneytalk